In the complex world of finance, hedge funds play a pivotal role in investment strategies and portfolio diversification. Among these, Hedgex Fund stands out as a dynamic player known for its innovative approaches and robust performance. This comprehensive guide delves into the core principles, investment strategies, and market impact associated with hedge funds, with a focus on Hedgex Fund.

Introduction to Hedgex Fund.com

Hedge funds are investment vehicles typically available only to accredited investors and institutional clients. They aim to generate returns by leveraging various strategies that often include alternative investments and derivatives. Unlike mutual funds, hedge funds have more flexibility in their investment approaches, allowing them to profit from market downturns as well as upswings.

Core Strategies Employed by Hedge Funds

Hedge funds like Hedgex Fund employ diverse strategies tailored to different market conditions and investor objectives:

- Long/Short Equity: This strategy involves taking long positions in stocks expected to appreciate and short positions in stocks expected to decline. Hedgex Fund utilizes detailed fundamental analysis and market research to identify undervalued and overvalued stocks.

- Global Macro: Global macro hedge funds analyze macroeconomic trends and geopolitical events to make investment decisions. Hedgex Fund may capitalize on currency fluctuations, interest rate differentials, and commodity price movements across global markets.

- Event-Driven: Event-driven strategies focus on capitalizing on corporate events such as mergers, acquisitions, restructurings, and bankruptcies. Hedgex Fund’s expertise in assessing the impact of these events on stock prices allows it to profit from mispricings and arbitrage opportunities.

- Quantitative Trading: Using mathematical models and algorithms, quantitative hedge funds like Hedgex Fund automate trading decisions based on statistical analysis and historical data patterns. This approach aims to exploit market inefficiencies and generate alpha.

- Fixed Income Arbitrage: Hedge funds engage in fixed income arbitrage by exploiting pricing discrepancies in fixed income securities. Hedgex Fund may profit from yield spreads, interest rate differentials, and credit quality differentials between bonds and other debt instruments.

Impact of Hedge Funds on Financial Markets

Hedge funds play a significant role in financial markets by providing liquidity, enhancing market efficiency, and contributing to price discovery. While their strategies may involve higher risks and complexities compared to traditional investments, hedge funds like Hedgex Fund often attract sophisticated investors seeking diversification and potential higher returns.

Risk Management and Performance Metrics

Effective risk management is crucial for hedge funds to protect investor capital and achieve sustainable growth. Hedgex Fund employs rigorous risk assessment techniques, stress testing, and portfolio diversification strategies to mitigate market volatility and downside risks. Performance metrics such as alpha, beta, Sharpe ratio, and drawdowns are used to evaluate fund performance relative to benchmarks and peers.

Regulatory Environment and Investor Considerations

Hedge funds operate within a regulatory framework designed to protect investors while allowing flexibility in investment strategies. Potential investors in funds like Hedgex Fund must meet accredited investor criteria and conduct thorough due diligence to understand fund objectives, fees, liquidity terms, and risk profiles.

Future Trends and Innovations

Looking ahead, hedge funds are likely to embrace technological innovations such as artificial intelligence, machine learning, and big data analytics to enhance investment decision-making and risk management processes. Hedgex Fund’s commitment to staying at the forefront of these advancements positions it well to navigate evolving market dynamics and deliver sustainable long-term value to investors.

Hedgex Fund Trading Partners

Hedgex Fund claims that it has established strong partnerships with reputable trading entities in the industry. Here are some of the trading partners associated with Hedgex Fund:

• Swissquote Bank: As a renowned Swiss bank and forex broker, Swissquote Bank offers Hedgex Fund access to a good trading infrastructure. Clients can benefit from Swissquote’s advanced trading platforms, competitive pricing, and extensive range of financial instruments.

• WinsorFX: Collaborating with WinsorFX allows Hedgex Fund to tap into their expertise in forex trading. WinsorFX is known for its innovative technology solutions, including advanced trading platforms and customizable trading tools. This partnership enables Hedgex Fund clients to access the global forex market.

• Advanced Markets: By partnering with Advanced Markets, Hedgex Fund gains access to institutional-grade liquidity and trading solutions. Advanced Markets is a leading provider of prime brokerage services, offering deep liquidity pools, low latency execution, and robust technology infrastructure.

• Match-Prime Liquidity: The partnership with Match-Prime Liquidity enhances Hedgex Fund’s liquidity capabilities. Match-Prime Liquidity specializes in providing reliable liquidity solutions to financial institutions and brokers, ensuring competitive pricing and efficient order execution.

Customer Support

Hedgex Fund claims to provide 24/7 customer support; however, it is important to note that the available contact information for reaching their customer support is not readily apparent. Despite their assertion of round-the-clock assistance, clients may find it challenging to locate valid contact details for direct communication. Instead, Hedgex Fund primarily relies on social media platforms such as Facebook, Instagram, Twitter, and Telegram to engage with their clients.

While social media platforms can serve as a means to stay connected and receive updates from the broker, they might not offer the same level of responsiveness or personalized support as direct communication channels. Clients should be aware that relying solely on social media platforms for customer support may limit their ability to address specific concerns or receive timely assistance.

Educational Resources

Hedgex Fund primarily focuses on investment management and financial services, but they also offer a range of educational resources to assist investors in gaining market insights and enhancing their trading knowledge.

Hedgex Fund primarily focuses on investment management and financial services, but they also offer a range of educational resources to assist investors in gaining market insights and enhancing their trading knowledge.

• Market Overview: Hedgex Fund provides regular market overviews and updates to help investors stay informed about the latest trends, news, and events impacting the financial markets. These overviews offer a broad perspective on various asset classes, including forex, stocks, commodities, and indices.

• Technical Analysis: The platform offers technical analysis reports and tools to assist traders in making informed trading decisions. These resources include chart patterns, indicators, and other technical analysis techniques that can be utilized to identify potential market trends, entry/exit points, and price patterns.

However, Hedgex Fund does not currently offer tutorial videos or webinars, which is a pity.

Review

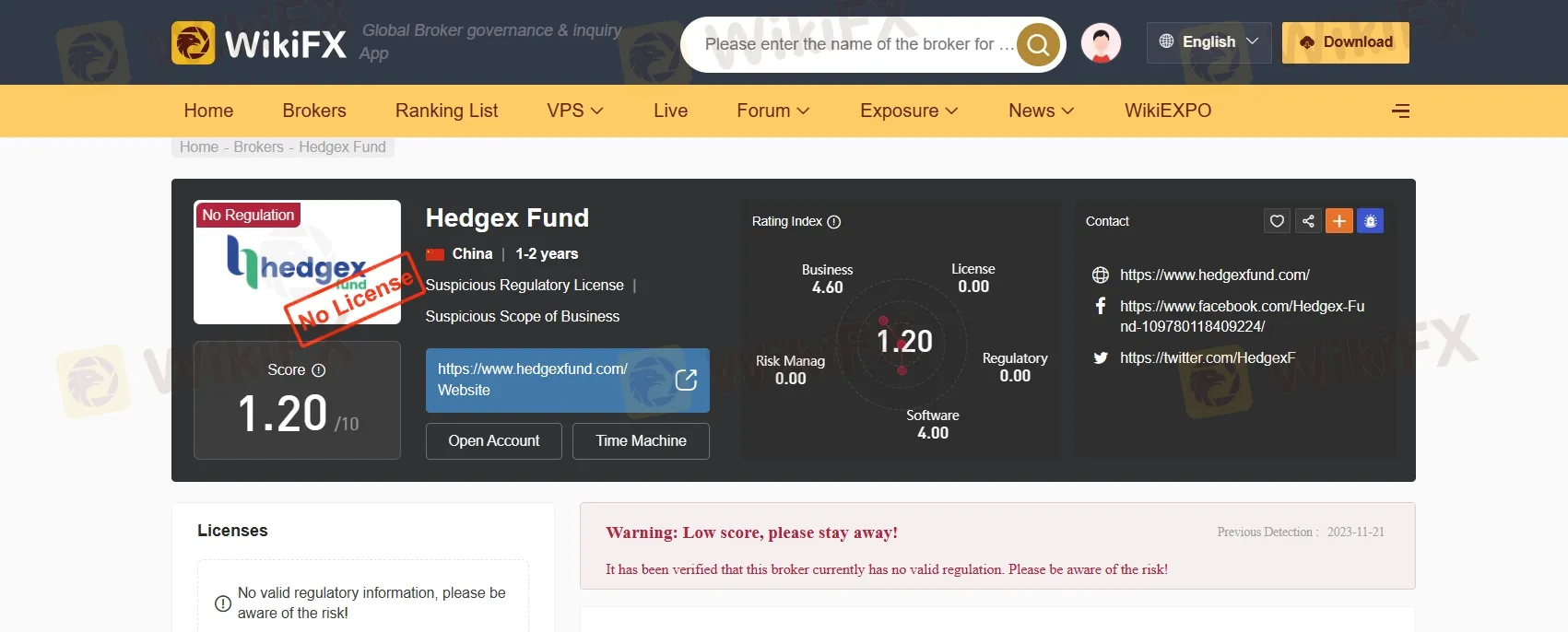

When we searched for Hedgex Fund on Wikifx. We found its a unlicensed and unregulated broker with a very low score of 1.20 out of 10. Also we noticed Wikifx issued warning by stating that Warning: Low score, please stay away!

When we searched for Hedgex Fund on Wikifx. We found its a unlicensed and unregulated broker with a very low score of 1.20 out of 10. Also we noticed Wikifx issued warning by stating that Warning: Low score, please stay away!

Conclusion

Hedge funds like Hedgex Fund play a vital role in the global financial landscape by offering sophisticated investment strategies, diversification benefits, and potential for attractive returns. Through a combination of rigorous research, disciplined risk management, and strategic execution, Hedgex Fund continues to redefine investment excellence and uphold its reputation as a trusted partner for institutional and high-net-worth investors seeking to achieve their financial goals in a dynamic market environment.